Are Accruals Included In The Income Statement? Demystifying Financial Reporting

TÓM TẮT

Accrual Concept Explained – By Saheb Academy

Keywords searched by users: Are accruals included in income statement Accruals, Accruals la gì, Under the accrual basis of accounting, Accruals concept, Accrual accounting la gì, Accounting and financial statements, The accrual basic accounting records revenues when they are, Income statement

Is Accrual In The Income Statement?

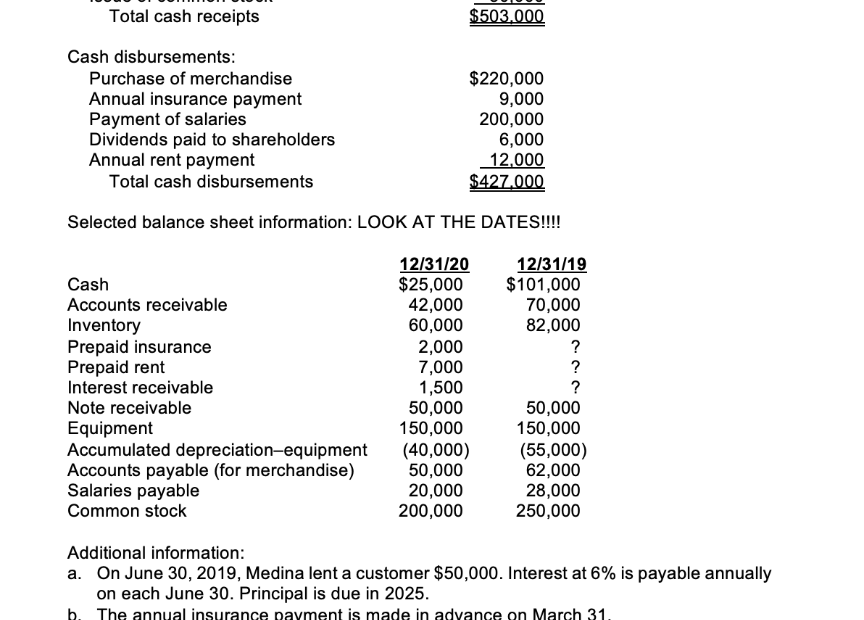

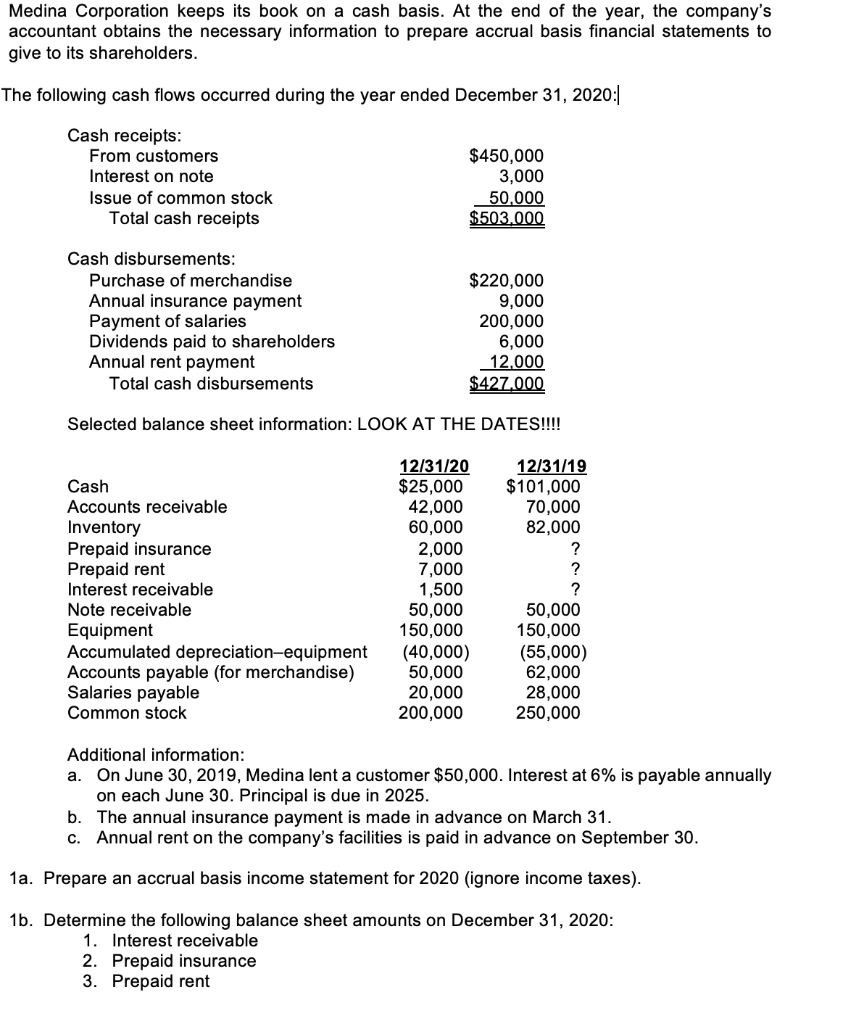

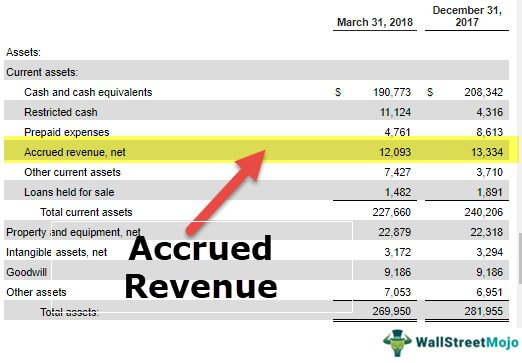

Accrual accounting plays a crucial role in the presentation of financial information. When a company earns revenue that has not yet been received in cash, it recognizes this as accrued revenue on its financial statements. Specifically, accrued revenue is recorded as revenue on the income statement, providing a comprehensive view of the company’s financial performance. Moreover, to reflect the amounts owed by customers, this accrued revenue is also accounted for on the balance sheet under the accounts receivable section. This dual representation in both the income statement and the balance sheet ensures that stakeholders have a clear picture of the company’s financial health and its outstanding revenue yet to be received.

How Are Accrued Expenses Recorded On Income Statement?

Accrued expenses are an important accounting concept used to account for costs that have been incurred but not yet paid. To record accrued expenses on an income statement, a two-step process is followed. First, an initial journal entry is made by debiting the relevant expense account, which reflects the cost incurred, and crediting an accrued liability account. This recognizes the obligation to pay the expense in the future.

However, it’s essential to note that this initial entry does not affect the income statement directly. Instead, it reflects the financial position on the balance sheet. The second step occurs in the subsequent accounting period, where a reversing journal entry is prepared. This entry involves debiting the accrued liability account to reduce it to zero and crediting the same expense account as in the initial entry. This reversal ensures that the expense is properly recognized in the income statement for the period in which it was incurred, aligning the financial statements with the economic reality of the business. In summary, accrued expenses are initially recorded on the balance sheet and later adjusted on the income statement to accurately reflect the company’s financial performance.

Is Accruals An Income Or Expense?

Is accrual an income or expense? Accruals, often referred to as accrued expenses, are accounting entries used to record expenses that have been incurred during one accounting period but will not be paid until a later accounting period. These accruals are distinct from Accounts Payable transactions because they typically involve expenses for which invoices have not yet been received and entered into the accounting system by the end of the year. In essence, accruals help businesses accurately match expenses to the periods in which they were incurred, even if the actual payment has not been made. This accounting practice ensures a more accurate representation of a company’s financial performance.

Summary 18 Are accruals included in income statement

Categories: Details 81 Are Accruals Included In Income Statement

See more here: buoitutrung.com

Accruals are revenues earned or expenses incurred that impact a company’s net income on the income statement, although cash related to the transaction has not yet changed hands. Accruals also affect the balance sheet, as they involve non-cash assets and liabilities.Once recognized, accrued revenue is recorded as revenue on the income statement. It is also recorded on the balance sheet under the accounts receivable.Accrued expenses are recognized by debiting the appropriate expense account and crediting an accrued liability account. A second journal entry must then be prepared in the following period to reverse the entry.

Learn more about the topic Are accruals included in income statement.

- What Are Accruals? How Accrual Accounting Works, With …

- What is accrued revenue? Examples & how to record It – Paddle

- Accrued Expense: What It Is, With Examples and Pros and Cons

- Year-End Accruals – Finance and Treasury – Princeton University

- What is an Accrual? | Definition | Xero UK

- What is an income statement | BDC.ca

See more: buoitutrung.com/tech